Dominion Energy: Environmental Justice Risks in 2022

Summary

In 2022, a client requested that Responsible Alpha develop 12 case studies and the underlying business, economic, and investment analysis used by 123 environmental, indigenous rights, and racial justice organizations in their letter to the Honorable Gary Gensler, Chair, U.S. Securities and Exchange Commission on the proposed rule "The Enhancement and Standardization of Climate-Related Disclosures for Investors."

Responsible Alpha's analysis suggests investors need companies to disclose their climate-related financial risks and strategies for managing them, their greenhouse gas (GHG) emissions, their plans to remain viable or thrive in a low-carbon future economy, and their financial resilience across these dimensions, as it relates to and is in support of the communities where these companies exist, and their impacts are often felt and underreported. To further buttress and support this analysis, Responsible Alpha wrote 12 business cases of which the case below on Dominion Energy is one.

As of 2022, Dominion Energy had $68 billion in market capitalization, $42 billion in outstanding fixed income securities, 17,000 employees, and a 53% equity ownership in joint venture Atlantic Coast Pipeline LLC (“ACP”) with Duke Energy.

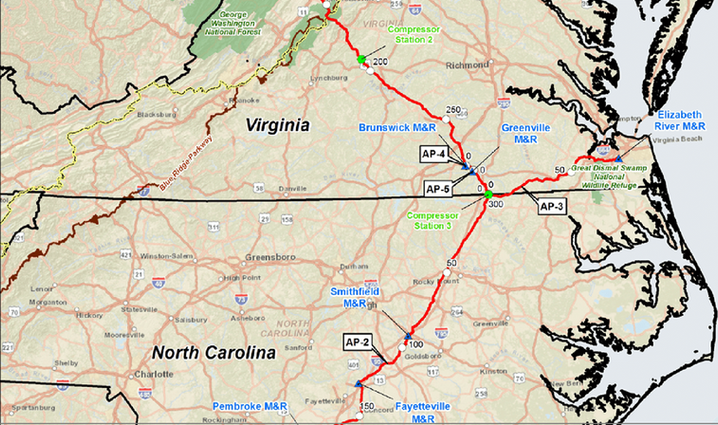

The Atlantic Coast Pipeline joint venture was a 604-mile-long natural gas pipeline with a capacity of 1.5 billion cubic feet of gas daily to alleviate a bottleneck to gas produced from the Marcellus Shale in Appalachia reaching growing markets in Virginia and North Carolina, including the Hampton Roads ports. It was to extend from Harrison Co., West Virginia to Robeson Co., North Carolina. Multiple locations of risk were identified, including more than 1000 water crossings in the State of Virginia alone. Three major sites of concern for public health are the pipeline compressor stations. The gas-powered compressors emit formaldehyde and methane and produce noise pollution. They are also a safety hazard. In 2015, a compressor station in Louisiana blew up, killing four workers and causing tens of millions of dollars in damage. Compressor sites are in Jane Lew, WV, a town of 500 people in Lewis Co., WV. Union Hill, VA, a historic Black community in Buckingham Co VA, and Garysburg, Northampton Co. NC, a predominantly Black community.

A previously proposed approximately 600-mile natural gas pipeline running from West Virginia through Virginia to North Carolina which would have been owned by Dominion Energy and Duke Energy was cancelled. Most community impacts were averted. One major impact that was not was the exercise of eminent domain in the acquisition of easements. Easements for 98 percent of the pipeline route have been secured and will be kept by Dominion for possible future use.

In July 2020, as a result of the continued permitting delays, growing legal uncertainties and the need to incur significant capital expenditures to maintain project timing before such uncertainties could be resolved, Dominion Energy and Duke Energy announced the cancellation of the Atlantic Coast Pipeline Project.

Environmental risks, community risks, and climate risks killed the $8 billion Atlantic Coast Pipeline, forcing multibillion-dollar writeoffs at Dominion and Duke.

Company Overview

Dominion Energy, Inc. produces and transports energy products. The Company offers natural gas and electric energy transmission, gathering, and storage solutions. Dominion Energy serves customers in the United States. Dominion dominates the American energy market as one of its top distributors of electricity and natural gas. The company serves some 7 million retail energy customers across eight US states, with a special concentration in Virginia, the Carolinas, and Ohio. The company has an energy portfolio with about 30,200 MW of generating capacity, 10,500 miles of electric transmission lines, 85,600 miles of electric distribution lines and 94,200 miles of gas distribution mains and related service facilities, which are supported by 6,200 miles of gas transmission, gathering and storage pipeline.

Climate Risks

Climate risks must be understood to include secondary risks from the production of fossil fuels, because the toxic releases and GHG production are one and the same process. In this line of reasoning (double materiality), poisoning the environment and communities through toxic emissions is a collateral climate impact. As such it should be disclosed, along with the costs of remediation.

Natural gas often escapes from pipelines through venting or flaring. Venting is the direct release of natural gas that occurs at different stages of the development process. Flaring is a process in which excess gas is burned and carbon dioxide is emitted into the atmosphere. Flaring and venting are major sources of greenhouse gasses entering the atmosphere, and these practices are pernicious to the earth’s climate. Venting is a particular problem of pipeline compressor units, which in the case of ACP, disproportionately impacted minority communities. The pipeline is routed through some of the poorest communities in each of the states, including the south-central Virginia arc of high-poverty counties, and continuing through eastern North Carolina. These include five BIPOC majority counties in North Carolina, and one of the 3 BIPOC majority counties in Virginia. For example, Robeson county NC is one of the poorest in the state, with a 2010 median household income of $30,608, and per capita income of $15,321. Demographically, Native Americans constitute 40% of the population, Blacks 24%, and Whites 32%.

Transition risk is significant for pipelines, and abandonment of the ACP project is attributable to such risk. According to ACP, “litigation risk, among other continuing execution risks, make the project too uncertain to justify investing more shareholder capital.”

Community Risks

Issues identified as community impacts associated with the pipeline development include exercise of eminent domain to take private property, safety, and water quality. Impacts to culturally significant sites are of major concern to Native American communities. Dominion offered four Native American tribes in Virginia and North Carolina $1 million each in exchange for agreeing to waive rights to present claims against the pipeline. The North Carolina tribes rejected the offer; the reaction of the Virginia tribes is unknown. The project would cross archaeological sites and other sites considered sacred by Native Americans whose ancestors have occupied the land for ten thousand years.

Another major concern for adjacent communities during pipeline operations are “high consequence” areas where the extent of damage to property or the chance of serious injury or death are significant. The ACP Environmental Impact Statement identified 24 high consequence areas in North Carolina alone. The blast zone for a 42-inch pipeline charged at maximum operating pressure would be 1155 feet in radius. The capacity of rural emergency management services to respond to a pipeline blast can be expected to be extremely limited and building the capacity would place a strain on local government resources. The number of annual incidents related to pipeline safety has grown more than sixfold between 2000 and 2020. This has been associated with accelerated construction driven by Federal Energy Regulatory Commission (FERC) guaranteed rates of return that have made pipeline building more profitable than gas production. Between 1997 and 2016, there have been 832 incidents, involving 310 fatalities and 1,299 injuries.

Air pollution stems from compressor operations and fugitive pipeline emissions. They contain formaldehyde and methane. Water pollution risks include contamination of groundwater from spills and leaching of chemical coatings known to be carcinogenic and cause birth defects (e.g., Scotchkote). Some of the pipe laid before the termination of the project failed a corrosion test. Many Appalachian communities along the route depend entirely upon groundwater, especially in zones of karst topography. Risk of disturbance and pollution are high during construction, and persistent due to the risks of groundwater contamination that can extend far from the site of a spill.

Environmental Risks

Disturbance during construction due to blasting and earth-moving is a major environmental concern. This is a function of steep terrain, environmentally sensitive communities and habitats of endangered species. The watersheds traversed are primarily headwater streams without Federal protection. In addition, the pipeline threatens to physically alter prime habitat for the economically important brook trout. The potential for pollution of the Chesapeake Bay due to sediment transfer when watersheds are disturbed during construction has been cited as another environmental concern. Air pollution threats include formaldehyde and methane. These are a particular concern at compressor sites. Fugitive emissions from pipeline leakage would affect air quality along the length of the pipeline. Water pollution threats include threats to groundwater from spills and the use of chemicals such as the epoxy coating of the pipes, a known carcinogen.

Risks Facing Dominion

-

October 2017: Dominion Energy entered into a guarantee agreement to support a portion of Atlantic Coast Pipeline’s obligation under a $3.4 billion revolving credit facility with a stated maturity date of October 2021. Atlantic Coast Pipeline informed Dominion Energy it intends to terminate and repay the outstanding balance of the revolving credit facility in the first quarter of 2021. As of December 31, 2020, Atlantic Coast Pipeline had borrowed $1.8 billion against the revolving credit facility. In July 2020, the capacity of the revolving credit facility was reduced from $3.4 billion to $1.9 billion. Dominion Energy’s Consolidated Balance Sheets include a liability of $6 million and $14 million associated with this guarantee agreement at December 31, 2020 and 2019, respectively.

-

March 2020: Dominion Energy completed the acquisition from Southern to acquire its 5% membership interest in Atlantic Coast Pipeline and its 100% ownership interest in Pivotal LNG, Inc., for $184 million in aggregate, plus certain purchase price adjustments.

-

July 2020: As a result of the continued permitting delays, growing legal uncertainties and the need to incur significant capital expenditures to maintain project timing before such uncertainties could be resolved, Dominion Energy and Duke Energy announced the cancellation of the Atlantic Coast Pipeline Project.

-

July 5, 2020: JP Morgan reported on the cancellation of the ACP, leading to a debt increase of $950 million for Dominion and $850 million for Duke Energy.

-

July 5, 2020: JP Morgan estimated a 3.5 percent to 4 percent negative earnings impact against Dominion and Duke for foregone equity in allowance for funds used during construction and incremental expenses for consolidated project debt.

-

2020: Net income attributable to Dominion Energy decreased $1.8 billion, primarily due to charges presented in discontinued operations associated with the cancellation of the Atlantic Coast Pipeline Project and related portions of the Supply Header Project. The Supply Header Project was a project previously intended for Dominion Energy Transmission, Inc. (DETI) to provide approximately 1,500,000 Dths of firm transportation service to various customer in connection with the Atlantic Coast Pipeline Project.

-

2020: Net income from discontinued operations including noncontrolling interests decreased $2.6 billion, primarily due to charges associated with the cancellation of the Atlantic Coast Pipeline Project and related portions of the Supply Header Project.

-

2020: In addition, Dominion Energy recorded equity earnings (losses) of $(2.3) billion, $117 million and $67 million in 2020, 2019 and 2018, respectively, in discontinued operations related to its investment in Atlantic Coast Pipeline.

-

2020: Fully impaired the related asset under construction which resulted in an equity method loss to Dominion Energy of $2.3 billion. In connection with Dominion Energy’s decision to sell substantially all of its gas transmission and storage operations, which it determined to be a strategic shift, Dominion Energy has reflected the results of its equity method investment in Atlantic Coast Pipeline as discontinued operations in its Consolidated Statements of Income.

-

2020: Dominion recorded a current liability due to the Atlantic Coast Pipeline in 2020 of $1.052 billion.

-

2020: Net income declined nearly 130% to a net loss of about $401 billion in 2020, primarily due to charges presented in discontinued operations associated with the cancellation of the Atlantic Coast Pipeline Project and related portions of the Supply Header Project.

Risks Facing Dominion’s Investors and Lenders

-

2020: Dominion Energy's heavy parent-debt load will not only weigh on the holding company's credit ratings but may also hurt its ability to support growth at its utility subsidiaries with equity contributions.

Conclusion

Production is facing regulatory headwinds due to growing opposition to fossil fuels. According to energy analysts, the Mid-Atlantic region has signaled lack of openness to further gas infrastructure development.

In the news release announcing the cancellation, ACP said “Specifically, the decision of the United States District Court for the District of Montana overturning long-standing federal permit authority for waterbody and wetland crossings (Nationwide Permit 12), followed by a Ninth Circuit ruling on May 28 indicating an appeal is not likely to be successful, are new and serious challenges. The potential for a Supreme Court stay of the district court's injunction would not ultimately change the judicial venue for appeal nor decrease the uncertainty associated with an eventual ruling. The Montana district court decision is also likely to prompt similar challenges in other Circuits related to permits issued under the nationwide program including for ACP.” shareholder concerns have been expressed in the form of proxy filings. In 2021, concerned shareholders called for full disclosure of lobbying activities and expenditure. Dominion’s board recommended against the proposal. Proponents argued that transparency and accountability in lobbying to influence policy is in the best interests of the shareholders, and specifically that lobbying activities may “jeopardize Dominion’s reputation to the detriment of shareholder value.”